What Does Spotminders Do?

Table of ContentsGet This Report on SpotmindersHow Spotminders can Save You Time, Stress, and Money.Facts About Spotminders RevealedThe Greatest Guide To SpotmindersThe smart Trick of Spotminders That Nobody is DiscussingSpotminders - Truths

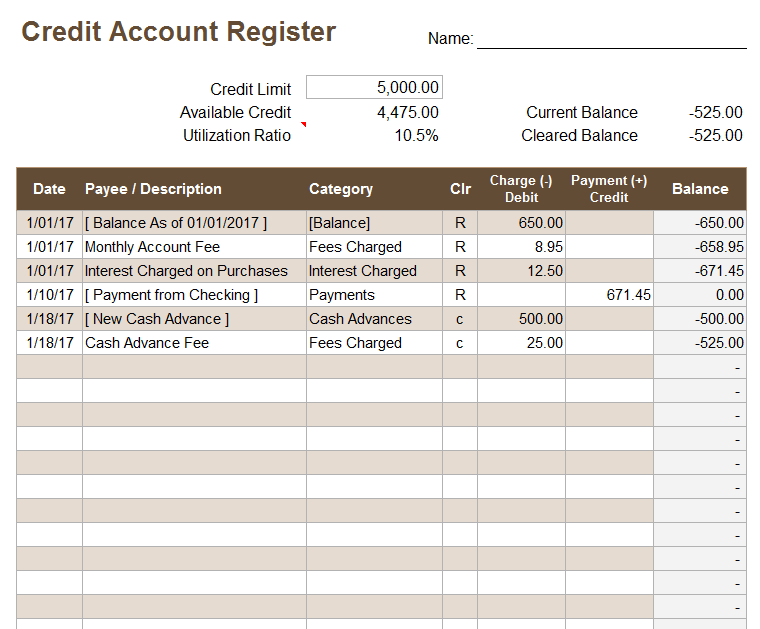

Date card was very first opened up Credit line you were authorized for. This aspects greatly right into Credit history questions stay on your debt report for 2 years. This influences your credit history rating, and calling card are not included For how long you have actually had the credit history card for and variables right into your credit report's calculation The annual fee connected with the charge card.

Do not hesitate to transform Utilizes solutions to computer system the number of days are left for you to strike your minimum spendUses the bonus offer and time structure columnsB When you got your benefit. There is conditional formatting here that will transform the cell eco-friendly when you input a date. Whether the card costs charges when making foreign transactions.

It's crucial to track canceled cards. Not just will this be a great scale for my credit history score, however numerous credit report card bonus offers reset after.

The Of Spotminders

Chase is by far one of the most stringiest with their 5/24 guideline yet AMEX, Citi, Funding One, all have their very own set of regulations as well (wallet tracker) (https://johnnylist.org/gosearch.php?q=Spotminders). I have actually developed a box on the "Existing Stock" tab that tracks the most usual and concrete guidelines when it comes to spinning. These are all finished with solutions and conditional formatting

Are you tired of missing out on potential financial savings and credit score card promos? Before I uncovered, I often clambered to select the best credit rating card at checkout.

Indicators on Spotminders You Need To Know

At some point, I wisened up and began jotting down which cards to use for everyday acquisitions like eating, grocery stores, and paying certain bills - https://fliphtml5.com/homepage/rjqwi/sp8tmndrscrd/. My system had not been ideal, however it was much better than absolutely nothing. CardPointers came along and transformed exactly how I managed my credit cards on the go, offering a much-needed solution to my predicament.

Which card should I make use of for this acquisition? Am I losing out on extra benefits or credit histories? Which bank card is really offering me the most effective return? This app addresses every one of that in secs. This blog post contains affiliate web links. I click reference may obtain a little compensation when you use my link to make a purchase.

It aids in selecting the appropriate credit rating card at checkout and tracks deals and incentives. bluetooth tracker. Lately featured as Apple's Application of the Day (May 2025), CardPointers aids me respond to the essential question: Available on Android and iOS (iPad and Apple Watch) gadgets, as well as Chrome and Safari internet browser expansions, it can be accessed wherever you are

An Unbiased View of Spotminders

In the ever-changing world of factors and miles provides become out-of-date rapidly. Not to state, sourcing all of this information is lengthy. CardPointers maintains us organized with information concerning all our bank card and aids us swiftly make a decision which cards to make use of for each purchase. Considering that the application updates immediately we can with confidence make the most enlightened decisions whenever.

Just in case you forgot card advantages, search for any type of card details. CardPointers' user-friendly user interface, along with faster ways, customized views, and widgets, makes navigating the app simple.

Some Ideas on Spotminders You Need To Know

Neglecting a card can be an apparent unseen area, so examine your in-app bank card profile twice a year and add your most recent cards as soon as you have actually been approved. This method, you're constantly up to date. CardPointers costs $50 a year (Normal: $72) or $168 for life time gain access to (Regular: $240).

If you think you'll enjoy this app, and conserve 30% off (smart wallet tracker). CardPointers offers a complimentary version and a paid version called CardPointers+. What's the distinction in between free vs. paid? The cost-free tier consists of basic features, such as including charge card (restricted to one of each type), seeing deals, and choosing the most effective credit history cards based on details purchases.

Some Known Questions About Spotminders.

Even this opt-out alternative is not offered for consumers to quit charge card companies and releasing banks from sharing this information with their economic affiliates and economic "joint marketing experts," a vaguely defined term that offers a huge loophole in privacy securities. Neither do customers obtain the transparency they should regarding just how their info is being shared.

When the reporter Kashmir Hillside tried to discover out what was being done with her Amazon/Chase bank card data, both companies basically stonewalled her. The impossible number of click-through agreements we're overloaded by online makes these notices simply part of a wave of small print and also less meaningful. In 2002, people in states around the nation began to rebel against this guideline by passing their own, harder "opt-in" financial personal privacy regulations needing individuals's affirmative approval prior to their info could be shared.